How SmartLinks Work (8)

Our links default to open in the web browser. The app can open but it’s dependent on the user permissions on their device. Shoppers have the ability to set their settings to redirect links to their retailer apps. We do sometimes see that operating systems and their respective versions may impact this ability.

Branding QR Code

We do recommend that your QR codes are branded, to make the consumer comfortable. The two choices would be the product or brand logo (which makes the consumer super comfortable), or the Click2Cart logo (which clearly communicates the action).

Below are some examples of branded QR codes:

Call to Action

The CTA needs to be super-clear to the user on what action will take place once they scan the QR code. Short CTAs like “Scan to Cart” or “Scan4More” that create an expectation you can “scan and go” work best.

QR Code Size

To be sure that your QR Codes are readable, we recommend printing no smaller than 1.25″ square. If the QR code is too small it may become too hard for the user to scan the code and or unreadable.

Below is an example of a QR code on packaging for a S’Mores Recipe:

Yes, using Click2Cart for QR codes can be added to products packaging, samples, handouts, ads, and more, to drive repurchase beyond-the-shelf.

• Adding a QR code to packaging makes for quick and simple reorders

• QR codes are great for carting whole recipes

• Shopper’s Choice UI’s can be customized with brand assets, by non-technical personnel

• QR codes can be customized to include brand logo and colors

No, SmartLinks do not expire. They do remain live and we don’t turn them off unless requested to do so. Therefore, if there are ads in the market beyond your campaign end date and consumers click on the link within your ad, you will see carting’s increase within your dashboard.

Agencies: Please keep in mind, if your campaigns run for longer than specified within your contract, you could be subject to incremental fees.

We are adding products to the retailer’s cart. We don’t change anything that is already in the cart, just add more to what is already there.

It is VERY important that you use the short link that starts with click2cart.com. The “long link” is actually the result of quite a bit of information processing on our end – that all happens in the blink of an eye! When a user clicks the short link, it alerts our system to:

1. Identify that a user has clicked.

2. Geolocates the user, if needed (if local retailers are included as a carting option)

3. Checks the inventory for the products in the link for that user, at the relevant store (or stores, if it is a multi-store link). Geography is relevant even for national retailers, because stock can be different in different delivery zones.

4. If any of the products are OOS or 3rd party for that user, checks inventory for potential substitute products and determines which subs would be used.

5. Then the system generates the “long link” that we send to the retailer, that you see in the address bar, and sends it to the retailer for the user.

6. Tracks to see if the user lets the cart complete (if not, we report this as a “process closed” – this is mostly a helpful measure of accidental clicks).

So – for any campaign, there can easily be 10-15 different “long URLs” generated over time or across geographies, over the course of the campaign. If you use the one long link that is generated for you, all of the other users will see only the results you got – in your geography, and in that moment in time – which may not work for other locations or other times. And, since you’re bypassing our system, we also can’t count the click, or the “process closed” users.

SmartCommerce is always trying to simplify the buying decision for the shopper – and that means only showing retailers who are geographically relevant to them, and that have the product in stock. When your link or implementation includes local retailers, to determine where a user is, we use their IP address and look it up using continually-updated services to determine their zip code. (Note: the IP address is not visible to SmartCommerce or to you when we do this … this is solely to power the consumer experience.). We then bump this zip code information against our list of retailer service areas, so that we know whether or not to show the retailer to the consumer.

Because (1) a user may be accessing from one place but actually ordering for another – like work and home, and (2) the system is not infallible (IP addresses can be obfuscated or spoofed by VPN, firewalls, etc.), we also automatically include an option for users to change their ”detected” zip code whenever local retailers are available.

A click on a Click2Cart link launches a back-end application that recognizes the desired products and retailer to use for carting.

This references the set of rules for that link (which lead products should be carted, in what quantities, and what substitute products to use if the lead products are out of stock).

This then generates the appropriate code or URL to pass to the retailer (every retailer has a different method of accepting products into their carts).

SmartLinks: Creating & Editing (13)

Absolutely! They also do not all have to come from your own brand. Fun fact: we’ve been told by many clients that their bundle links have higher CTRs than single-product links (with some exceptions, like recipes, which can have lower CTRs if overloaded with ingredients).

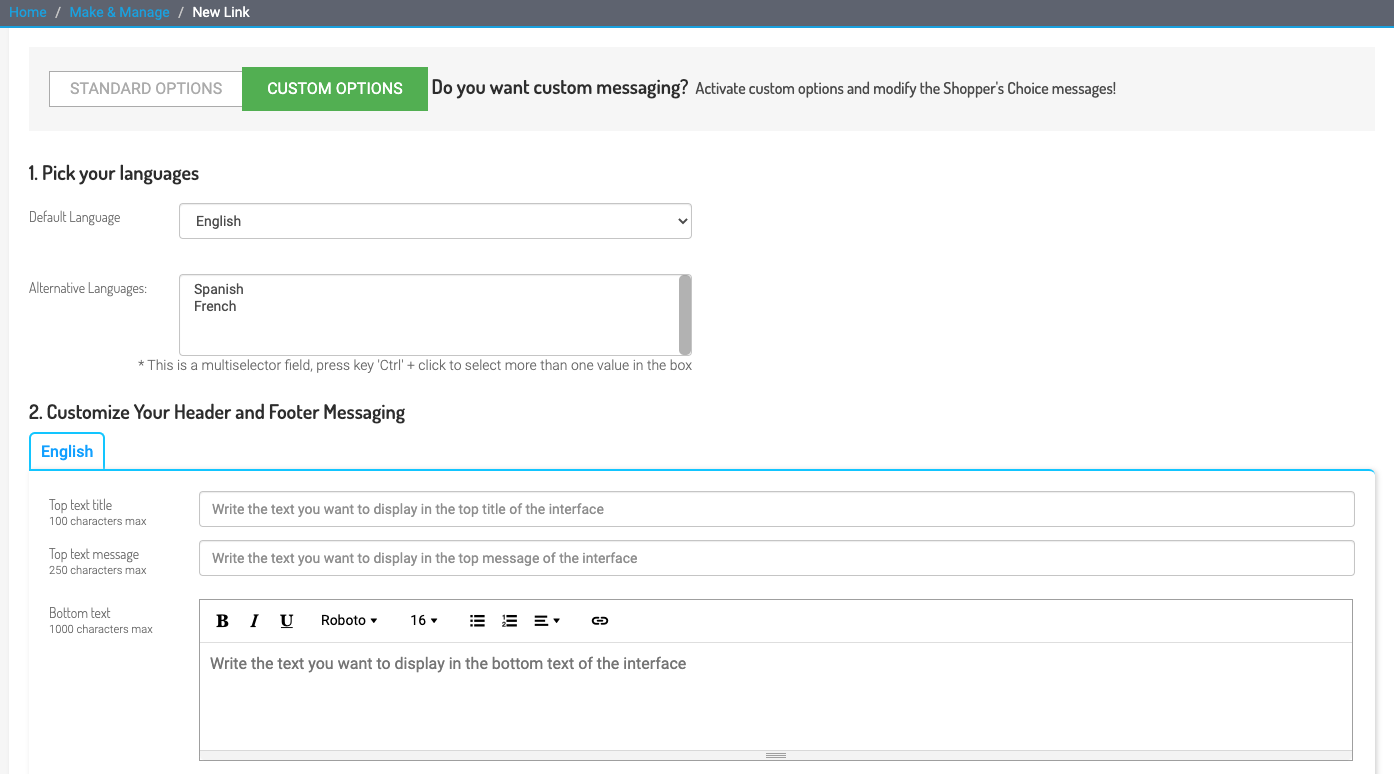

Yes. The character limit for a branded Shopper’s Choice message is as follows:

Top text title: 100 characters max

Top text message: 250 characters max

Bottom text: 1000 characters max

At this time, we are unable to control text wrapping, font type or font size. We can control font color.

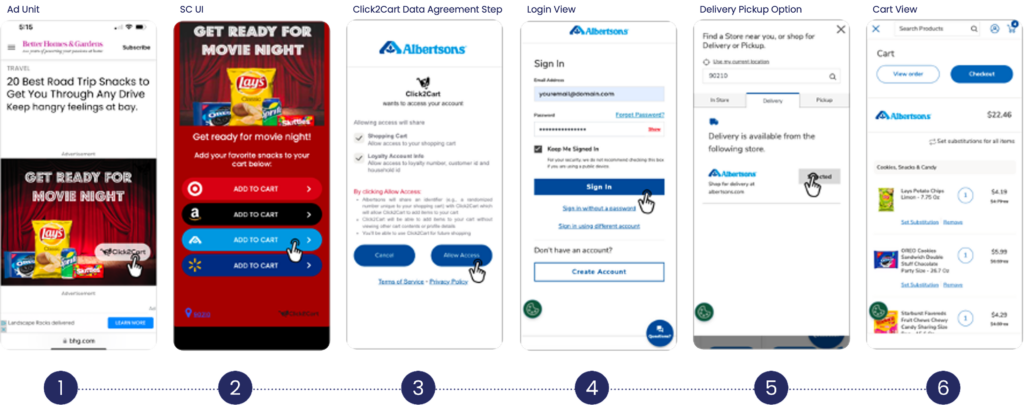

Below is a view of the custom messaging options for a branded Shopper’s Choice SmartLink:

Many products go in and out of stock during standards campaigns. Our standard functionality uses SmartSubstitution to automatically substitute in-stock package sizes of your products when one package size goes out of stock. If you are worried that ALL package sizes will go out of stock during your campaign, you can designate a backup product (meaning, a completely different product, not just package size) as a backup. Please ask your SmartCommerce Client Success Lead for more information.

Of course, we always recommend reducing the number of choices – but in the case where you really do need to offer a choice of sizes, we’d recommend using Shopper’s Choice. This will let the shopper select their size and send the product directly to their retailer of choice.

To minimize the potential drop off from this page it would be best if you could select a single retailer (e.g. Shopper’s Choice – Product Choice UI) to drive to, so the only “choice” is among product sizes. It would be a bit less complex for a consumer to choose only a size vs having to select from a list of sizes and then from a list of retailers.

This applies specifically to occasions where a product is sized (e.g. Small, Medium, Large), not for package size. In those cases, your results are always better if you select a size for the shopper, and let them change it in the cart if they like.

For Click2Cart:

• Lightweight CTAs (ones that create an expectation you can “cart and go” work better than ones that sound long/heavy: “buy now” or “shop now”• Use product bundles (from your brand, or across brands or even categories) to let a shopper cart multiple products at once.

• In emails, it is easy to use several Click2Cart links together to let the shopper choose among products with still one click (for sizes, flavors, etc.)

• Integrated offers can be carried to the retailer, and drive clicks

For Shopper’s Choice:

• Use only when needed to let the shopper make a choice of retailers or to select products– for example, if they have to select a size or color of product. For a bundle, it is almost always better to cart everything and let the user delete from the cart later if desired.

• Same CTA best practices apply.

SmartCommerce can cart at several local retailers who provide *BOPIS/delivery, and can “add to the shopping list” at Amazon Fresh – for shoppers in the relevant market area for these retailers.

If you are doing geo-targeted Shopper Marketing, advertising to a selected audience, or sending to a captive retailer list, these can work very well.

Yes, provided that the retailer can accept the coupon directly into the cart, and of course that the retailer knows to apply the coupon. Most retailers can, and we are happy to work with you to test a coupon code with/for a brand before they run a campaign.

If all the products within your bundled link are available, they will all get transferred at once. If a product within the bundle becomes unavailable, only the select set of products that are available at that retailer will cart.

You can bundle anything that the retailer sells … even things that are not from the same brand.

The idea is that you want the bundling to be helpful … to decrease the amount of thinking/work on the part of the user … and if you put too much in the bundle, you complicate the decision and you get fewer clicks.

On recipes, for example, we’ve found that you get the most carting when you limit the carting bundle to the key items – and the ones the shopper is least likely to have on hand.

No, but depending on the campaign the number of products can reach a point where it is detrimental to campaign performance.

Please consult with your SmartCommerce Client Success Lead for best practices guidance.

Yes, for each URL/link creation process, as well as during editing, the list of products and retailers can be ordered as you prefer – and you can have retailers show up in random order, if you’d like, for “fair and equitable” consideration.

All of the links can be edited once created – at ANY point, even after they are created. Click on URLS and the type of link to access the list of URLS. From here you click on the pencil icon to edit the link.

We have a SmartCommerce user dashboard that lets anyone fairly easily create a link, provided that the brand’s products are active in our system.

If you are a Brand or Agency with an annual subscription, all of your products should be continuously available to you for links – you can make links in less than a minute (and if you want help, we’re always happy to make them with or for you. If you are an Agency doing a one-off campaign, you can use the campaign request form to give us the basic information, and we will create the links for you.

SmartCarting: Click2Cart Dynamic Optimization (3)

When a Lead product is OOS:

DIRECT SUBSTITUTION: Check through all lead product variants (same product, different package) in order of closest pack size

INDIRECT SUBSTITUTION: Check through all similar products from your brand (determined by you) in all pack sizes

Net/Net: When a Lead product is OOS, Direct and Indirect substitution are used to give EVERY opportunity for some version of the product, or similar product, to be carted – often checking dozens or more potential backup SKUs! As a result, the incidence of OOS messages on properly set up campaigns is almost always 0%.

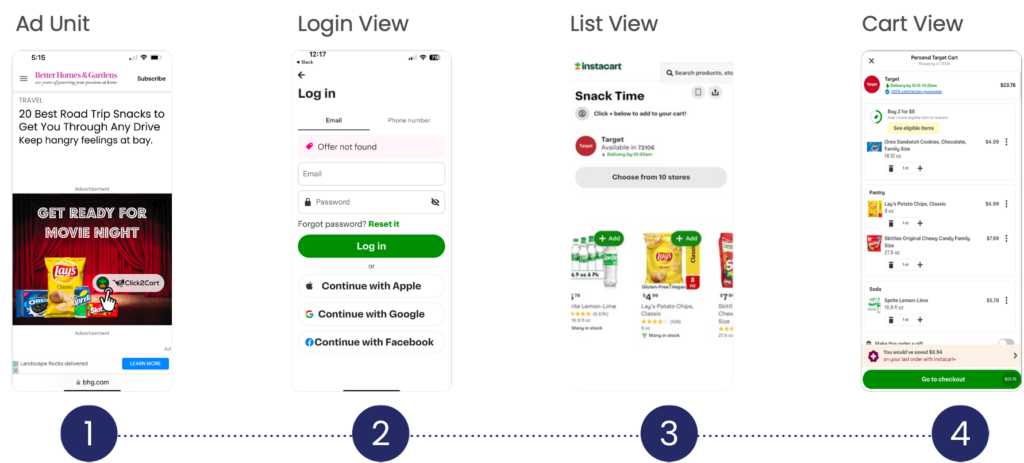

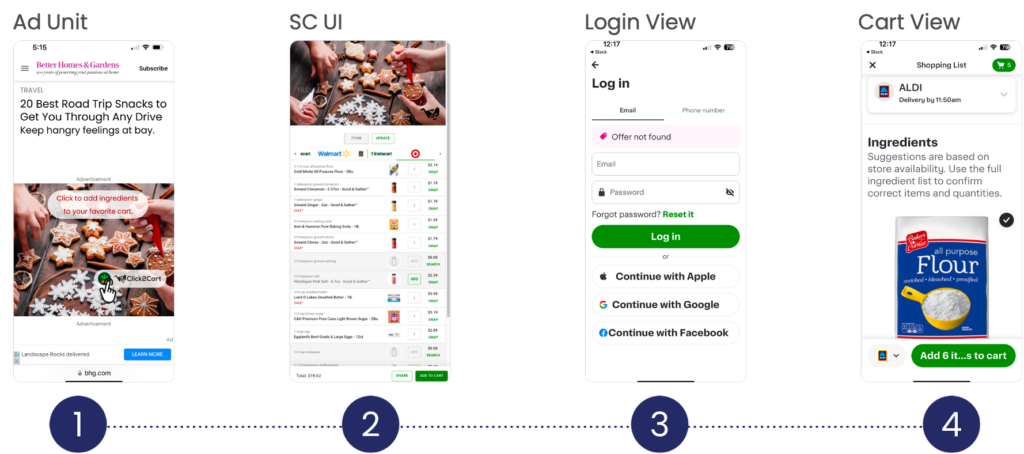

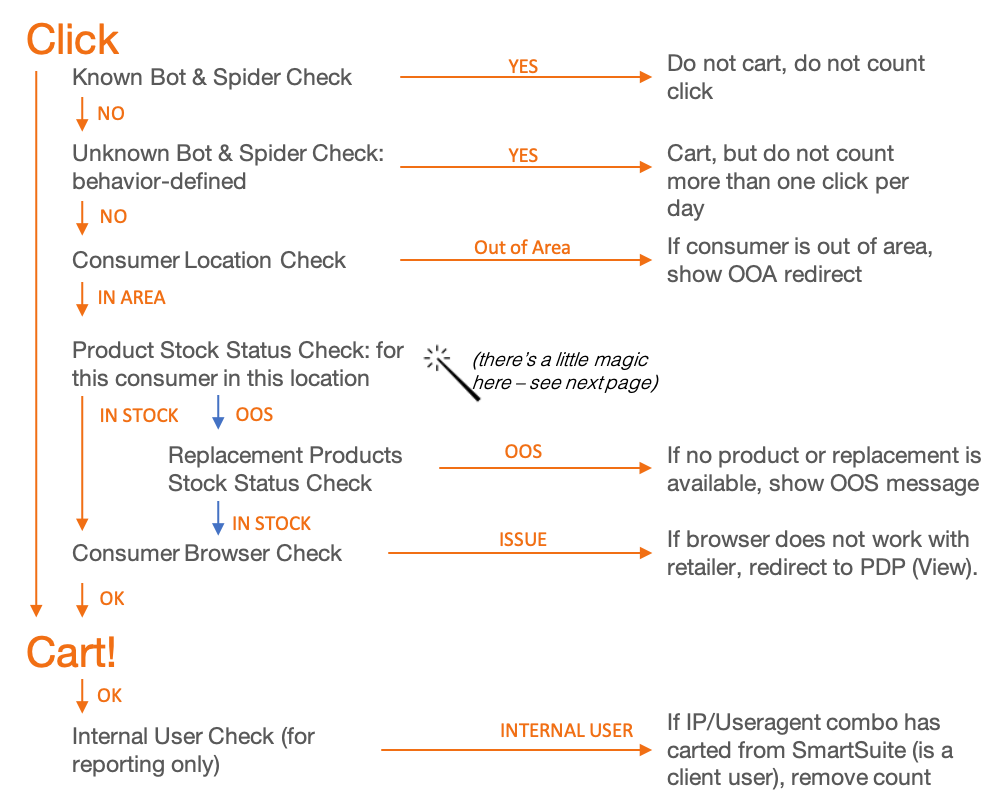

The magic between a Click and a Cart

The below overview illustrates what happens between a consumer click and a product landing in a cart. In a perfect world, all clicks would be counted, and all clicks would drive transfers – but in the real world, we have to account for bots, varying stock status, geographic targeting misses, and other speed bumps.

While filtering is a bit of an art (because bots are tricky!), our objective is to always be reasonably conservative, so you can feel confident that the reported cart transfers reflect your actual results!

What most shoppers see:

What actually happens:

Click2Cart® applications always drive Direct to Cart wherever possible...but for challenging retailers or consumers with incompatible browsers (where carting might otherwise not work), SmartCarting dynamically optimizes to the best option for each user in the moment.

SmartLinks: Tagging Shopper's Choice Links (1)

To add a tracking pixel to a Shopper’s Choice page, SmartCommerce uses Google Tag Manager. We can add your Google Tag Manager container ID (containing any cookie/pixel you like) to the UI. If you are dropping a cookie/pixel on the consumer, in almost all cases you will need to prompt for permissions (it’s set up to do that – you’ll need to let us know if your application is an exception to this), which will of course reduce the number of orders that make it through to the cart.

If you don’t have a GTM container set up, we can build one for you (the cost is $1000 for the build). If you already have one, great, we’ll gladly help set it up for your Shopper’s Choice – please send it and we’ll gladly include it in your link!

If you have any questions, please let us know.

SmartLinks: Best Practices (7)

Use the Right SmartLink URL

TO USE

Simply copy your link exactly from SmartSuite or the email sent to you, as shown in this example. It will look like https://click2cart.com/xxxx (where the xxxx is replaced with your unique campaign information

WHAT NOT TO DO

Never click on your link and copy the resulting URL from your browser. Doing so will result in loss of link tracking and SmartCommerce functionality.

Data Says:

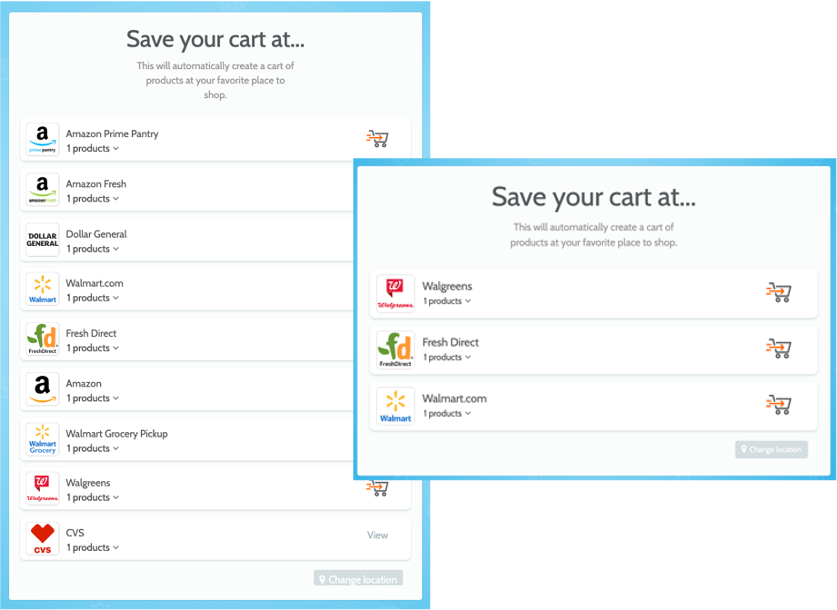

While it is tempting to show EVERY retailer available to a consumer, showing three or fewer store choices (ideally a mix of local and .com options) drives double the carting of four or more!

For non-perishable products, consumers are more likely to choose National/shipping retailers over Local/Delivery retailers, so you will get significantly higher carting if you include at least one.

Simple UIs

- The most lightweight and simple UI for retailer or product choice, optimized for action.

- No assets needed to build in SmartSuite (or to have SmartCommerce build for you)

Branded UIs

- You can carry your message to the landing page:

- Helps consumers feel more comfortable and tied to the brand as they select a retailer

- Allows you to add extra product information (videos, specs, a review, etc.) if needed, to aid selection.

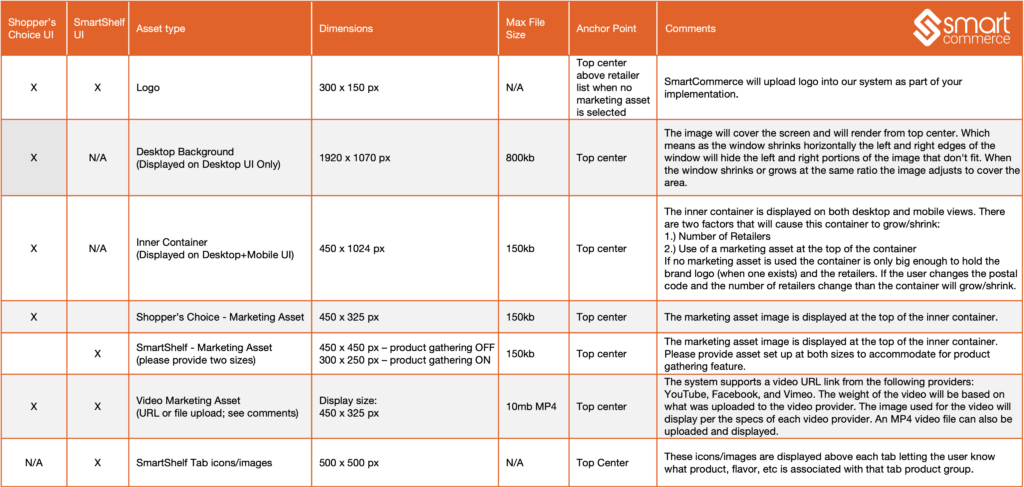

- Requires standard assets (see following two pages for details)

SmartShelf UIs: for products that require choice of size, gender, flavor, color, etc.

- You can carry your message to the landing page:

- Helps consumers feel more comfortable and tied to the brand as they select a retailer

- Allows you to add extra product information (videos, specs, a review, etc.) if needed, to aid selection.

- Custom filter options be applied allowing the consumer to select size, gender, flavor, color, etc

- Allows for cross-brand carting from a single link

- Requires standard assets (see following two pages for details)

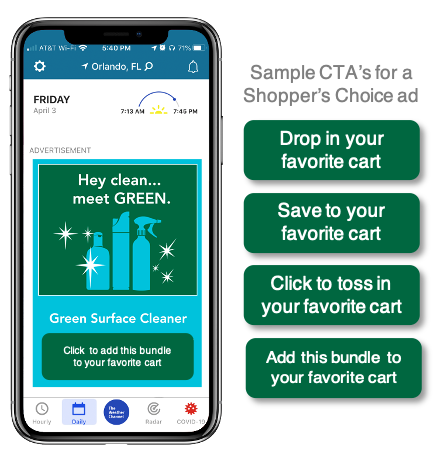

ALL CTAs

- Include lightweight CTAs, such as “Click to save to cart” or “Click to toss in your cart” / Eliminate heavy CTAs, such as “Buy now” or “Shop now”

- Use the word “click” to make recommended actions clear and/or a “click” symbol, such as a finger or pointer icon

- When bundling products, include the number of bundled items in your CTA, e.g.: “Click to add these 3 products to your cart”

Click2Cart CTAs: Special Note

- Be sure to indicate where consumers will be sent when using a Click2Cart ad, e.g.: “Click to save to your Walmart cart”

Shopper’s Choice CTAs: Special note

- Indicate that the consumer will be presented a choice of stores, e.g.: “Click to drop this in your favorite store’s cart”.

*Note: the word “retailer” is foreign to most consumers.

How to set up your creative assets for your branded Shopper’s Choice links

Less is more when it comes to branding your Shopper’s Choice links. The best landing pages have enough “branding” to maintain continuity from your ad to the branded landing page, but not so much as to distract the consumer from carting. Below are some best practices for your Shopper’s Choice graphics.

Click2Cart Direct

Carts on click from Ad

Highest Carting Rate – (Preferred)

Use to cart 1-to-many products with a single retailer:

- The shopper carts in one click!

- Use: Whenever possible, to drive the highest carting rate. NOTE: Have multiple flavors, etc.? Cart a bundle of products here and let the consumer curate in the car (not the UI), to reduce friction and increase sales

- Limitation: No consumer choice of Retailer or product

- Recommended uses: Shopper, Display Ads, Social, Email, Chatbots, QR Codes

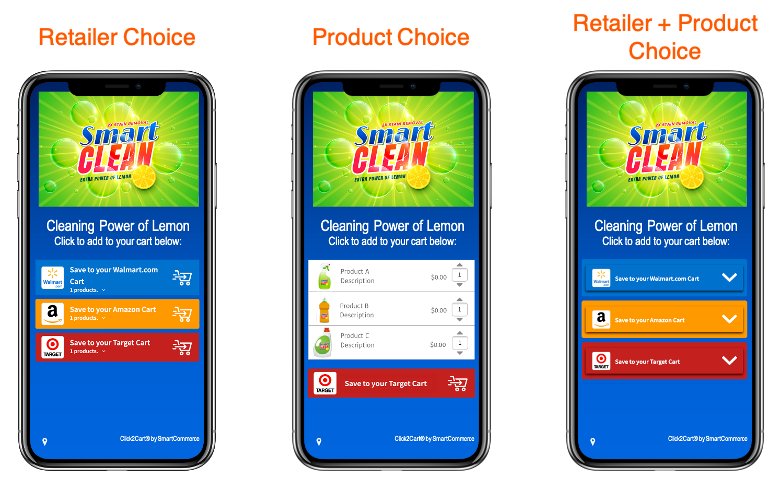

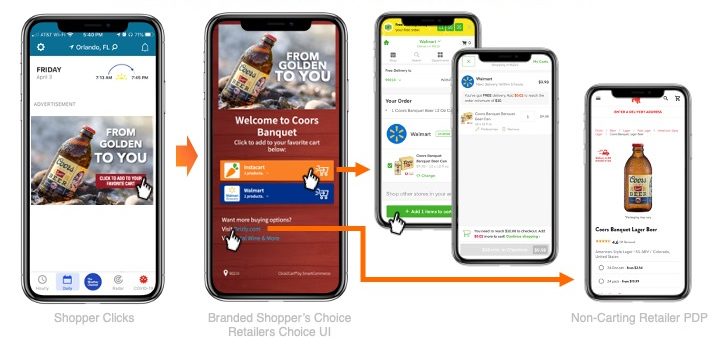

Shopper’s Choice: Retailer OR Product Choice

Carts on 2nd click (from UI)

Medium Carting Rate

Use to present a choice of retailers (for a bundle of 1-to-many products):

- Lets the shopper choose the retailer (or product at a single retailer).

- Use: When you need to enable a retailer or product choice

- Important Note: Requiring retailer AND product choice can negatively impact carting rate

- Recommended uses: National Ads, Social,

- Chatbots, QR Codes, Curated Lists (i.e. Recipes)

Shopper’s Choice: Retailer AND Product Choice

Carts on 2nd or 3rd Click (UI)

Lower Carting Rate

Use ONLY when you must present a choice of both products/product sizes (diapers, etc.) AND retailers

- Lets the shopper choose the retailer and products transferred.

- Use: When you MUST enable a product type choice AND a retailer choice

- Recommended uses: National Ads, Social, Chatbots, QR Codes, Curated Lists (i.e. Recipes)

SmartLink & SmartSite Demo Gifs (3)

About Retailers (13)

At this time the retailer’s eCommerce platform doesn’t allow products to be carted from outside their site. Until they add that capability we are unable to cart with them.

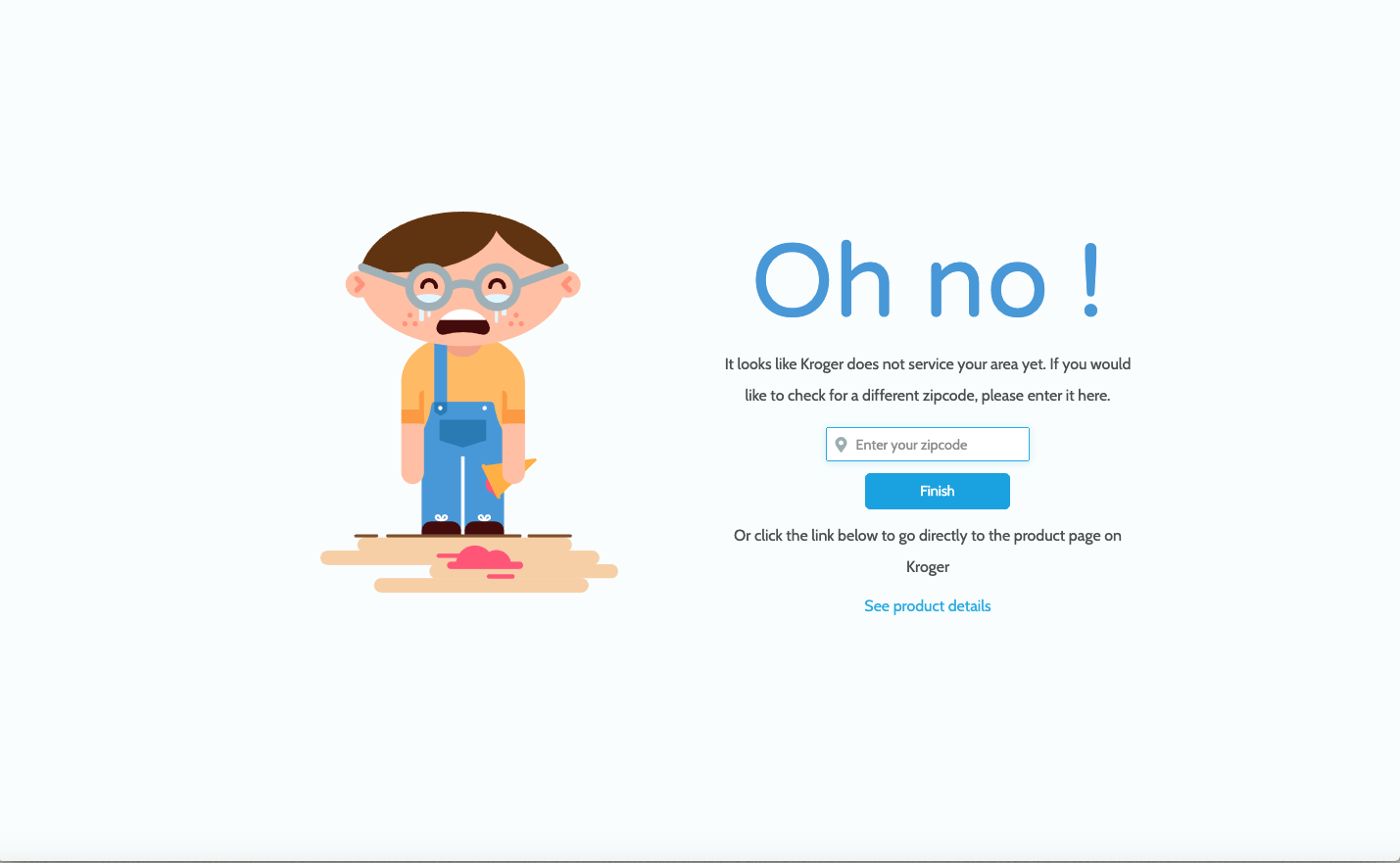

If a shopper clicks on a SmartLink that is servicing a retailer located outside of their service area they will be presented with the following message:

The shopper is given the choice to enter a different zip code or to visit the retailer’s product description page by clicking on the “See product details” link. If the user clicks the “See product details” link they will be presented with additional purchase options based on that retailers offerings.

We currently group out of area and out of stocks as redirects in your SmartSuite dashboard.

During periods of unusually high demand – for example, during the COVID-19 crisis – stock status can be highly variable, sometimes to the point of being unmanageable, even for the retailer. In these cases, SmartCommerce will increase our stock status surveillance, but shoppers may still occasionally encounter difficulties carting. We will alert you during these periods.

SmartCommerce is optimized for retailers that are primarily direct to consumer, not 3rd party – and where products are offered in a consistent and somewhat predictable manner (not auctions, for example). Even though it is a marketplace, Amazon is a great partner – is actually one of our top partners. Sites like Worten or Mercado Libre that are marketplace-only can have results that are unpredictable, so we may suggest some limits in how they are used/displayed – please check with your Client Success Lead. Auction sites like eBay, that are not themselves live retailers, are not eligible for the Click2Cart network.

We are always seeking to add retailers to our Network, and do not charge retailers for these orders. If you have a retailer you’d like to see added, including local, small businesses, please let us know!

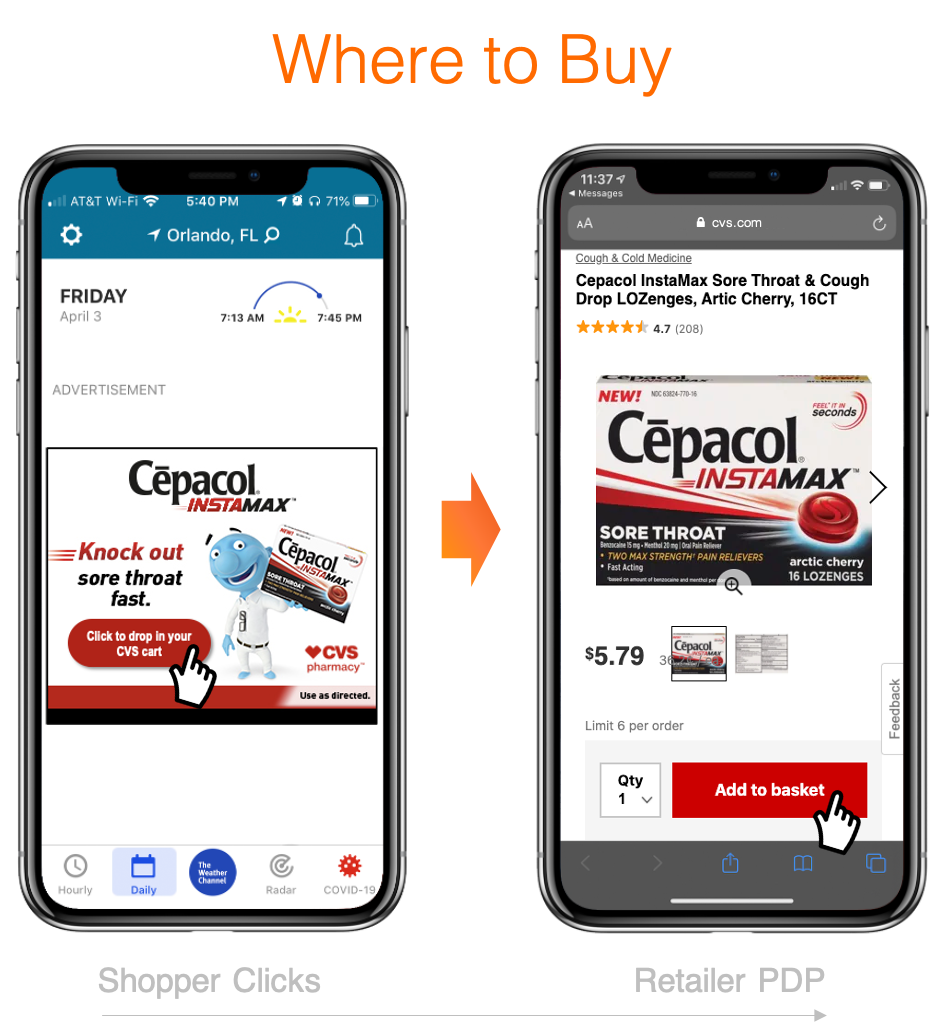

SmartCommerce can include non-carting retailers in all SmartLinks, buttons, etc. with single products. The SmartLink will send shoppers to the Product Detail Page at the retailer, rather than carting the products. All other functionality – SmartSubstitution, etc. – is still applied.

Carting retailers are those retailers currently in the SmartCommerce Retailer Network (National and Local) that can receive orders directly into their carts. For non-carting retailers, we can direct to their Product Detail Pages (like a “where to buy” provider) as a fallback. For a full list of our retailers, please visit the Retailer Overview & List page within the Client Resource Center.

Any extra steps in the cart path lose 80-95% of shoppers on the path to purchase, and requiring login can lose even more. SmartCommerce actively discourages all of our partner retailers from requiring a login, but some of them have legacy systems that require this step, so they cannot make a change without updating their systems.

In the meantime, the best way to help minimize the impact is to note in the CTA that the retailer will require a login. We do this in Shopper’s Choice UIs by adding a lock symbol to the retailer name.

Yes, we geolocate users and show local retailers only to consumers who are in the retailer service area. For more on how we geolocate users, see the question on Geolocation in How Links Work.

There are no technical/application limitations (except the number of retailers who carry the product), but there definitely are best practices! Remember, that the worst outcome with Shopper’s Choice is the consumer making no choice at all. We’ve learned that consumers make a choice almost twice as often when there are 3 or fewer retailer options displayed to them. There are exceptions – but that’s the general rule. So, if you have all National retailers (which would show to all consumers), you should consider limiting to three – or at the most, four. If you have local retailers added (meaning that only the consumers in their market area would see them), you can do 1-2 more, knowing that each individual consumer will see only a subset.

SmartCommerce can send orders to virtually all retailers that are capable of accepting external orders directly into carts – in the US and Internationally.

At this time, most national .com retailers, and many local *BOPIS” or delivery retailers can receive orders, and we are adding others as soon as they are cart-enabled. You can always access our most up to date list by visiting the Retailer Overview & List page within the Client Resource Center.

Carting at Instacart (2)

We recommend building and testing links across a 5-10 key geographic regions for your product and campaign/site before enabling Instacart as a carting choice. And, always work closely with your Client Success Lead, who can help guide your decisions.

Carting at Target (2)

They may, but it will be seamless within the Target interface, and will happen after carting. Target uses Shipt as their local delivery option in many areas.

Target is “direct to cart,” retailer which is ideal. The shopper clicks on a Click2Cart link, and the product or products are added directly into the Target cart. If the shopper is in a logged in state they proceed to checkout. It’s pretty seamless.

Walmart Grocery Pickup (4)

Our SmartLinks work to bridge from intent to the cart – we don’t know or track the pickup options. That means that in situations where no delivery or pickup options are available in the coming days, the product may remain in the cart for a while. While it is frustrating for the brand (and the consumer!) to wait for the sale, it has the added benefit of potentially triggering retailer-side retargeting to bring the consumer back to the store … essentially amplifying product visibility and driving more exposure, at no cost to the brand.

Normally (when stock levels are not unduly impacted by COVID), our local stock status information is quite good. During these unusual times, however, we’ve learned that the information we get from retailers is a lot less reliable, for both online and local products, but particularly for local products. While we can determine which locations carry the product, current stock status may be incorrect. Some products may be available on a “ship to home” basis, as a backup during times of high demand.

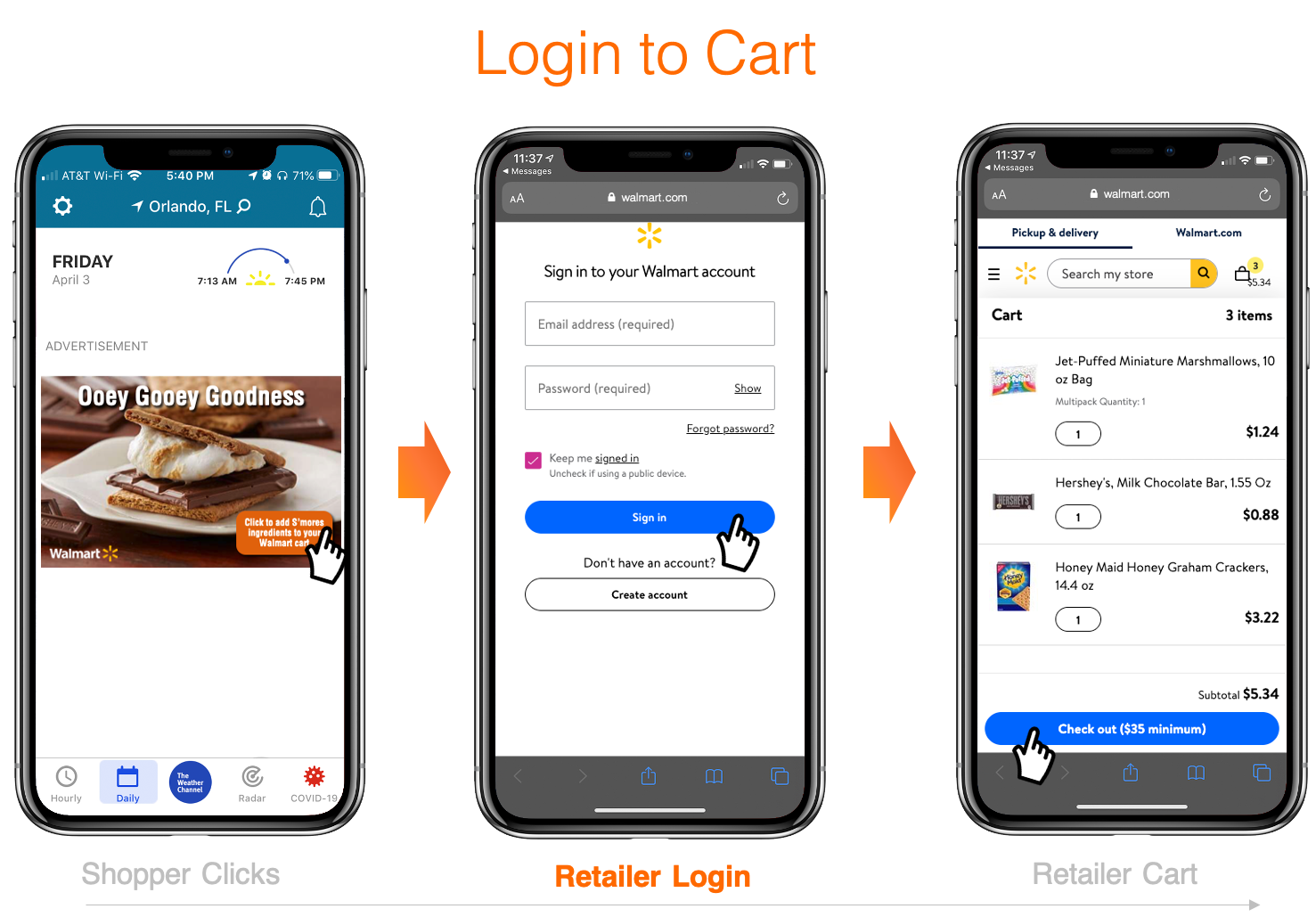

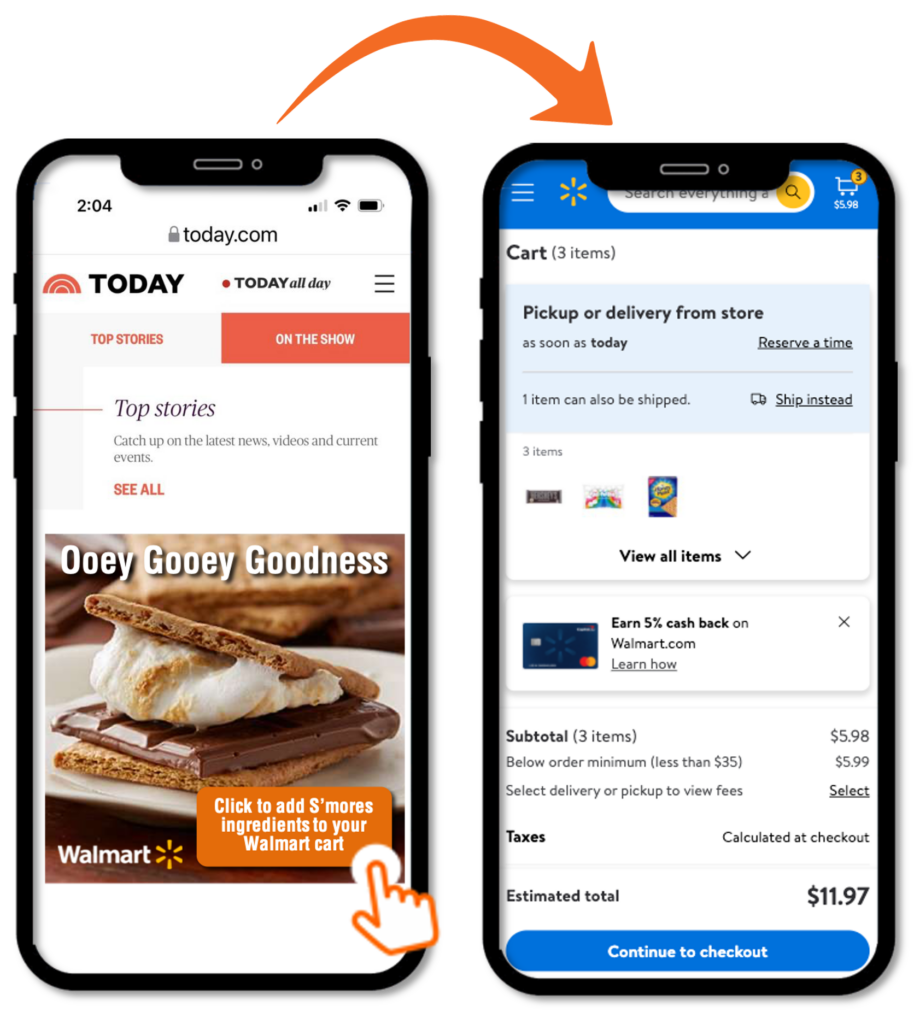

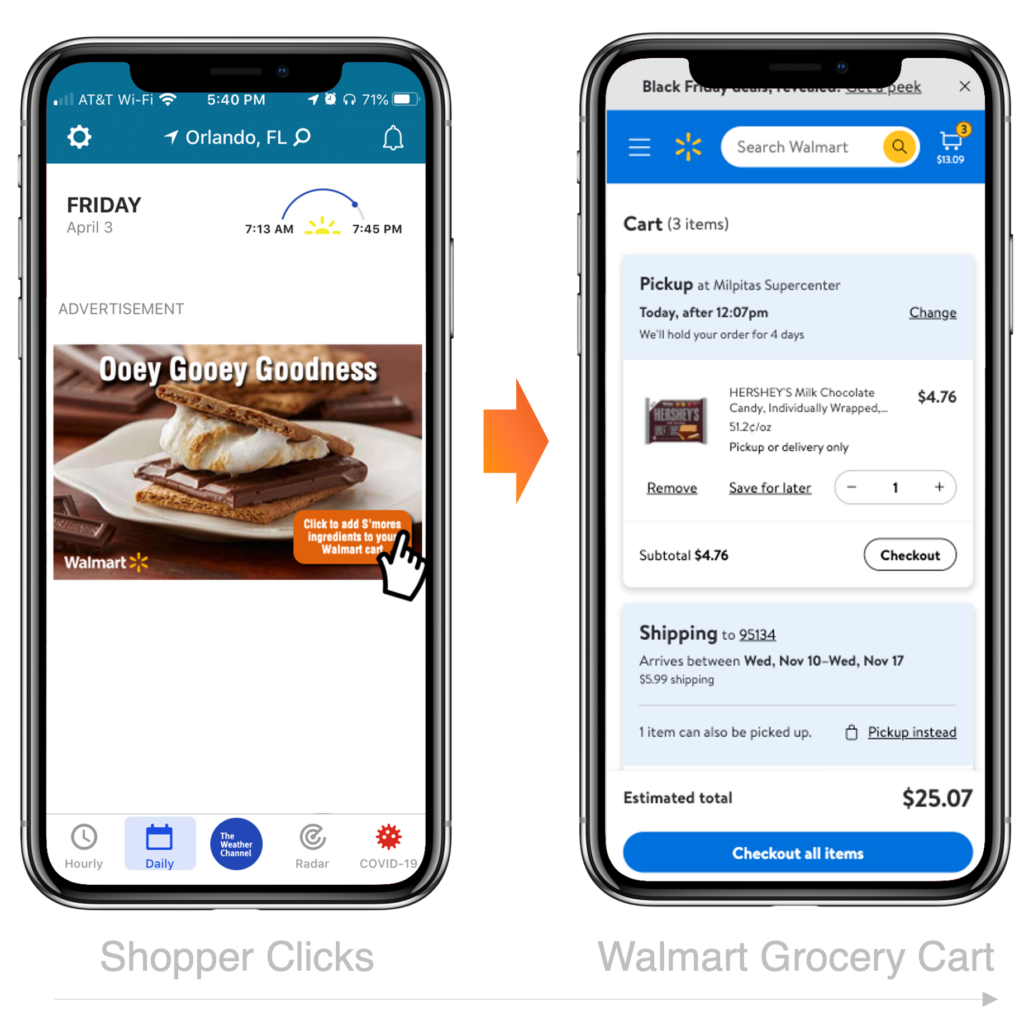

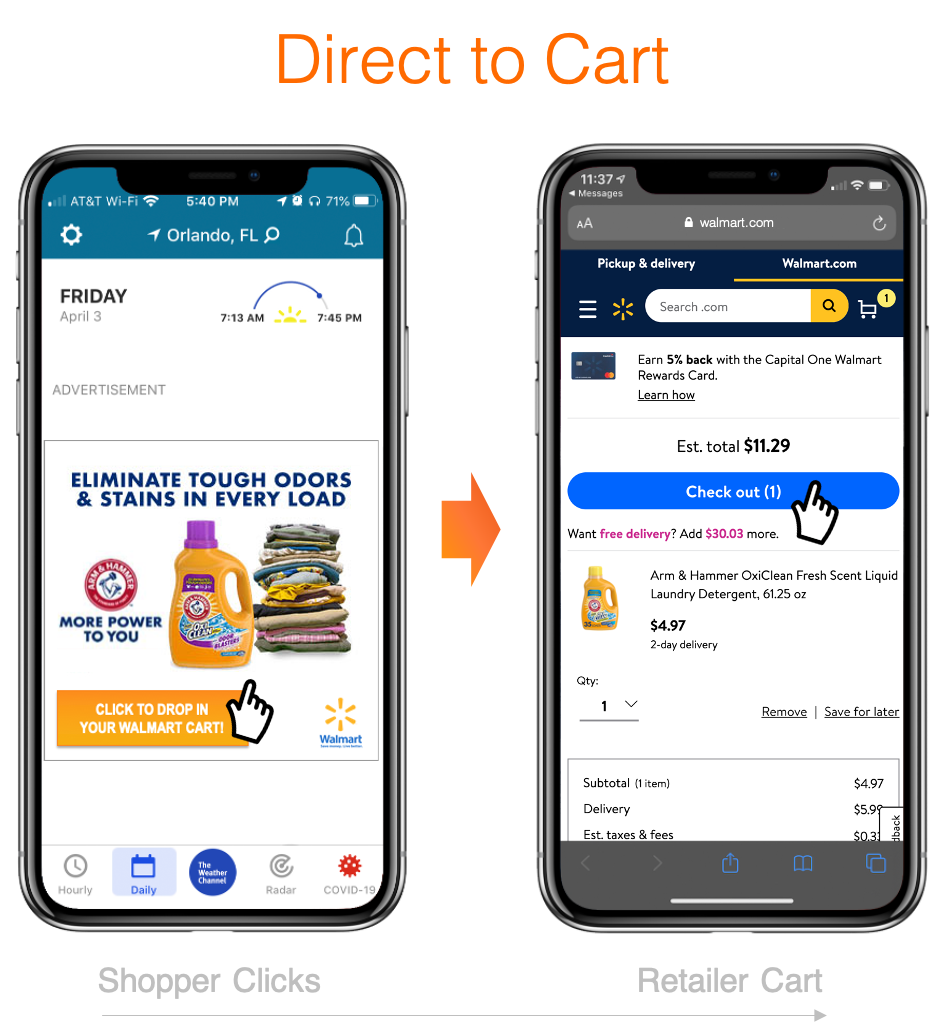

After overhauling their consumer facing website, Walmart has unified the experiences from Walmart.com and Walmart Grocery & Pickup. Walmart no longer requires users to login for product(s) to be added into the cart, nor does it cart through the Walmart app. This change creates a “direct to cart” experience. Below is the carting flow from a Click2Cart link.

We use the service radius that Walmart provides – generally, it’s the same used for their advertising purposes, and reflects reasonable commute perimeters and patterns for each store. If they are in a location not served by OG, we display an “Out of Area” message letting them know that they are not in a store service area, and giving them the opportunity to change their zip (in case they are looking from work but have a Walmart close to their home, for example). Unless the shopper enters a valid zip code, “Out of Area” messages are counted as a “redirect” in our system (and in your dashboard), same as an Out of Stock.

Carting at Walmart.com (2)

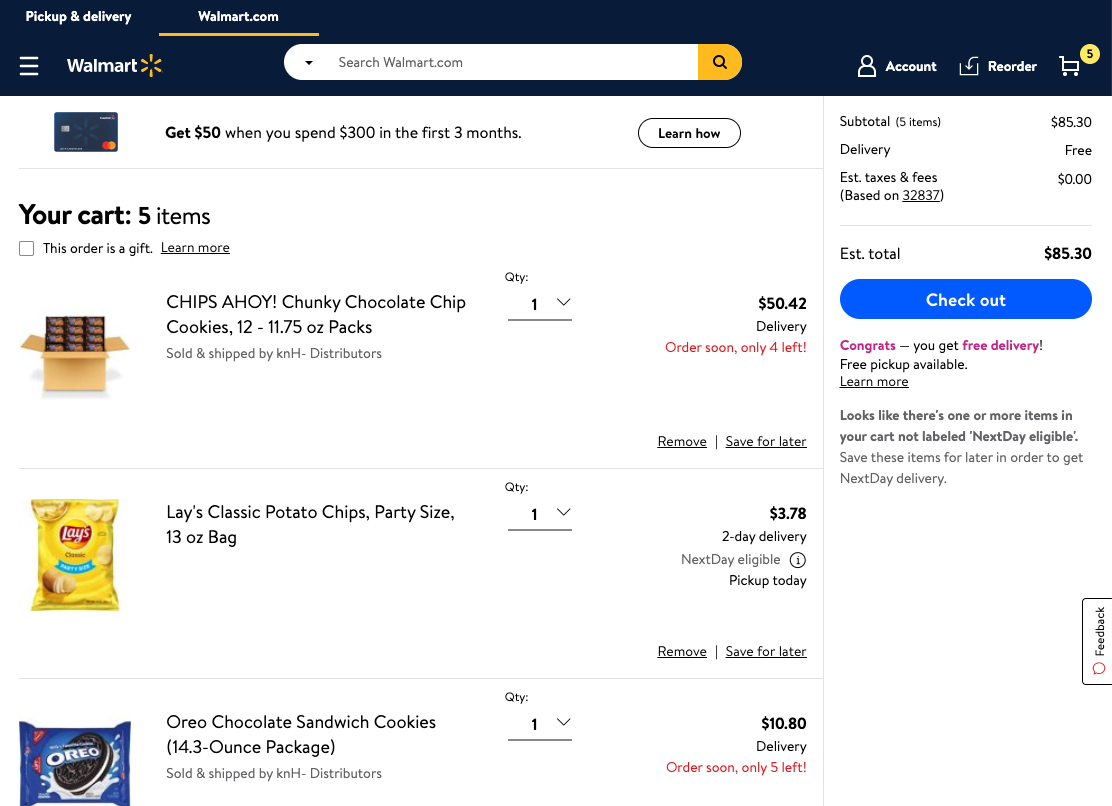

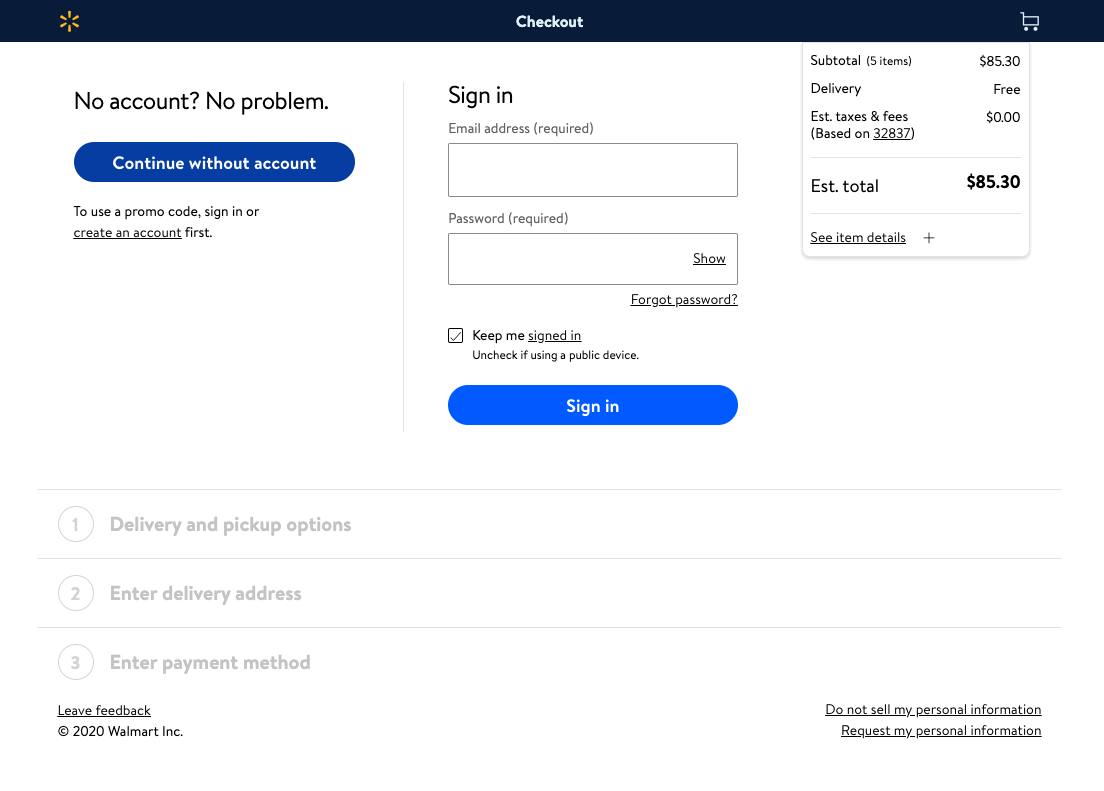

Unlike Walmart Grocery, Walmart.com does not require user to create an account prior to checkout. The user flow for a shopper without a Walmart.com account is as follows.

When the shopper clicks on a Click2Cart link associated with Walmart.com items are automatically added to a cart as shown below:

When shopper clicks “Check Out” they will see the following screen giving them the option to continue without an account:

Walmart.com is “direct to cart,” retailer. The shopper clicks on a Click2Cart link, and the product or products are added directly into the Walmart.com cart. If the shopper is in a logged in state they proceed to checkout.

Retailer Carting Flows (5)

Only for the few non-carting retailers, drives consumers to the Retailer PDP, instead of the cart.

Benefits of using SmartCommerce vs. Linking Directly to the PDP

• SmartSubstitution technology, so when a product is out of stock, we send consumers to an alternative product PDP that is in-stock and within your brand family, at that retailer

• Tracking within our SmartSuite portal, along with the other carting retailers

• Avoids sending consumers to an “OOS PDP” (which are massively used for cross-selling to brand’s competitors)

• Allows for automatic carting if, at any time, the product is added to the API

Amazon is a confirm to cart retailer. Consumer is prompted to confirm they want to add the product into their cart (an extra click).

Product is added directly to a retailer cart with no barriers (i.e.: login, confirmation button, etc.)

Using Click2Cart for Alcohol Brands (2)

Advertising laws in the Alcohol category change rapidly, and we do not monitor them and cannot warrant our services to be compliant with category limitations and laws. Any use of Click2Cart technology for alcohol brands or any other controlled substance is at your own risk as the advertiser.

Until we build an alcohol-specific UI, the things to be aware of are:

• We do not handle any age-gating or similar on the path to purchase, either Direct to Cart or Shopper’s Choice.

• Our Shopper’s Choice UI will show retailers that (1) have the product in stock and (2) are geographically relevant to that user (meaning, that they are in the shipping, pickup, or delivery area, as applicable). This could include local retailers like Instacart, Amazon Fresh, Walmart OGP, and Kroger (and others, but this is the usual list requested) if they have the product in stock.

• We do not have a capacity for blocking access to the Shopper’s Choice if there is not a minimum number of retailers available. This may or may not be relevant to your brand, but we have been asked for it in the past.

• You may also include additional static retailer links at the bottom of the UI, if desired, to include Out of Network retailers.

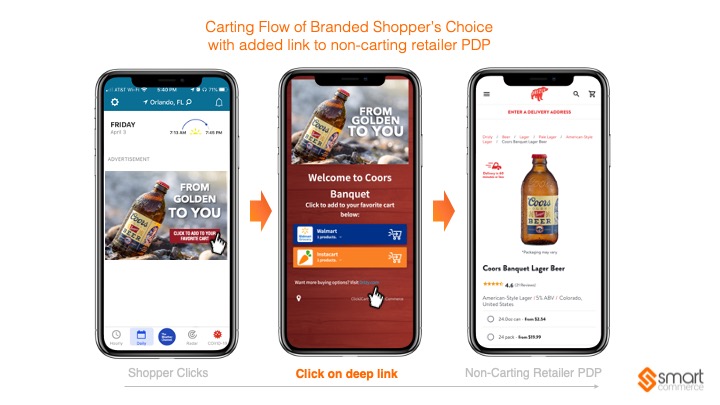

Below are two sample carting flows for alcohol brands. Both examples include deep links to non-carting alcohol retailers on the bottom of the Shopper’s Choice, Retailers Choice UI. For a single product a deep link can direct user to retailer PDP, but when carting alcohol bundles we recommend either going to top of site to let consumer make the product choice (as there are multiple products… or go to the lead product, as show in the second example below.

Alcohol Brands Carting Flow: Single Product using Multi-Retailer Branded Shopper’s Choice with added links to not-carting retailer PDP

Alcohol Brands Carting Flow: Multiple Products using Multi-Retailer Branded Shopper’s Choice with added links to not-carting retailer PDP

Case Studies & Benchmarks (4)

We track what goes into the cart, at what price, etc … but cannot track conversions within the cart. In controlled tests we have seen a range of 8-11%.

ROAS is just ONE measure of the success of a campaign, or even the process of putting a product in a cart:

• The ad itself is often just the first part of a purchase funnel that begins on a subsequent product exposure (seeing in-store, online, etc.)

• Products put in carts are generally not purchased immediately – in tests, we have seen them be purchased up to 6 months later!

• Getting a product in a cart and not checking out immediately tends to trigger retailer retargeting (free bonus boost to awareness!)

• Getting a product in a cart (even if never purchased) is a signal to the retailer that the consumer is interested in that brand, which influences the algorithm for that brand showing in future search results and voice orders

• Getting a product in a cart (even if the consumer later removes it) means the consumer has at least one additional exposure to the product/brand (when they remove the product), which can help build awareness and reminders to buy offline. Many consumers actually report saving things to online carts as a reminder to purchase them offline later.

Yes! Among studies with retailers who provide decent conversion data (see below for more on what we mean by “decent,”) and also some unique cases where we could isolate the results of a single campaign/site, we can offer that the conversion rate for carting from brand websites/influencers tends to be 30 – 38%, and carting from ads/social tends to be 8-11%. There are some wild exceptions, but those are solid benchmarks.

The reason we have to provide benchmarks is that most retailers do not provide reporting beyond “affiliate” data, which generally doesn’t work for Click2Cart links as they look for same-session sales (and Click2Cart encourages users to cart and go).

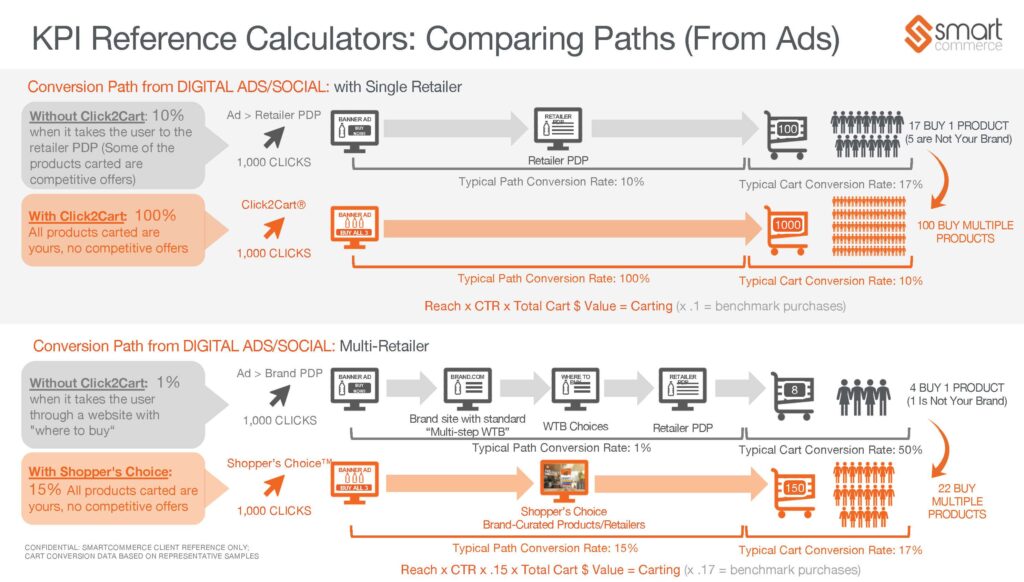

Let’s separate out THREE key benchmark numbers that are relevant to any campaign Path to Purchase. The second two benchmarks (what happens after the click) are illustrated at the bottom. Below provides more detail:

1. The Reach-to-Click Conversion (Click2Cart has minimal/no impact)

2. The Click-to-Cart Conversion

3. The Cart-to-Purchase Conversion (Click2Cart has minimal/no impact)

Let’s look at those one at a time.

1. Reach-to-Click is essentially your Click Through Rate. In most cases, this is not impacted by Click2Cart being present, unless your creative does a great job of “selling” the ease of Click2Cart. One place we DO see a little lift by using C2C is if you are carting a bundle – for some reason, clients have reported CTRs of 1.2x – 2x the CTR with smart bundles.

2. The Click-to-Cart Conversion % measures how many shoppers get lost between the initial click, and the cart. From ads/social (websites are different), we see a click-to-cart conversion rate of about:

• Without Click2Cart: 1% when it takes the user through a website with “where to buy”

• Without Click2Cart: 10% when it takes the user to the retailer PDP (and unfortunately, some of the product carted is a competitive offer)

• With Click2Cart + Shopper’s Choice: 15% (and happily, all of it is your products, and can be multi-product)

• With Click2Cart: 100% (all yours, and can be multi-product).

3. The Cart-to-Purchase Conversion measures what % of carted products actually are purchased. Remember that at this point, the number that made it to the cart is the denominator – and the denominator WITH Click2Cart is hugely larger, vs. WITHOUT C2C. Please see the graphic for detail, but the topline is that:

• Without Click2Cart: Going through a website with “where to buy”, about 50% of the 1% that make it to the cart, convert. Net conversion: .5%

• Without Click2Cart: Going through the retailer PDP, about 17% of the 10% convert (and unfortunately, some of the product carted is a competitive offer). Net conversion: 1.7%

• With Click2Cart + Shopper’s Choice: About 17% of the 15% convert (and happily, all of it is your products, and can be multi-product). Net conversion: 2.5%

• With Click2Cart: About 10% of the 100% convert (all yours, and can be multi-product). Net conversion: 10%

One last thing to note: Online conversion (#3) is only ONE reason to put products in carts (the number in #2). Additional reasons: Getting a product in a cart and not checking out immediately tends to trigger retailer retargeting (free bonus boost to awareness!)

Getting a product in a cart (even if never purchased) is a signal to the retailer that the consumer is interested in that brand, which influences the algorithm for that brand showing in future search results and voice orders

Getting a product in a cart (even if the consumer later removes it) means the consumer has at least one additional exposure to the product/brand (when they remove the product), which can help build awareness and reminders to buy offline. Many consumers actually report saving things to online carts as a reminder to purchase them offline later.

Conversion Benchmarks: Click2Cart from owned properties

(websites, email, etc.)

Shoppers who visit your website directly or have opted into direct contact are likely already predisposed to purchase your products. As a result, we see higher conversion rates among these shoppers, overall (vs. ad traffic).

Conversion Benchmarks: Click2Cart from Ads

Shoppers who click on ads are a mix of curious-to-committed consumers … even including some accidental clicks! As a result, the conversion rates are lower … but with strong reach, can result in massive sales!

NOTE: Path to purchase and conversion metrics are FOR REFERENCE ONLY. These are based on averages obtained from analysis of available brand data, and on available conversion data from participating retailers. We have noticed significant variances by product/category – your results may vary from these and will vary from site to site and campaign to campaign.

We do have some campaign spotlights that we can share with the brand names removed. Since each campaign is SO unique – different products, different creative, different categories, different reach, different retailers, different methodologies (Click2Cart, or different forms of Shopper’s Choice), we’re hesitant to just give random case studies. The best “benchmark” is that your clicks probably won’t change (sometimes they go up a bit), but your click rate will become your carting rate.

Visit our Presentation Toolkit page to view our gallery of blinded Campaign Spotlights.

Data Management and Product Unification (6)

Yes, we can enable 3P sellers, but do not recommend it, for two primary reasons.

• The brand loses quality control, as a 3P seller has had possession of the product – which is particularly critical for a product that is ingested, like food or health care

• The price is often wildly out of line – for example, see the comparison of your product at Walmart (1P) vs Amazon (3P) right now:

Generally speaking the brands prefer not to enrich/encourage 3P sellers, because they compete directly with the brand for sales.

That said, we can enable 3P … just wanted you to be aware of these considerations.

The Click2Cart® solution does not collect or store PII data. All Click2Cart reporting is done in the aggregate and anonymized … so you will know, for example, how many people carted, and which products, at what price, from what location, etc. … but you will not know about the individual consumer. However, there are two ways that we can enable data collection or even cookies from your side:

1. If an action takes place on your website and you know the consumer (and/or have the right to cookie them), we can “subscribe” you to the action the consumer takes on the site, so you can store/cookie based on that action.

2. In any Click2Cart functionality involving a website or SmartCommerce landing page (such as Shopper’s Choice), you can choose to use Google Tag Manager to carry your cookies. The interface will ask for cookie permissions prior to firing.

Stock status and price are updated at least every hour for products in use in any link, and more often (up to every carting) for very active products.

Given the volatility of local stock status, we have found that even the retailer can be providing inaccurate information in their APIs/Feeds (and actually, often are missing most local data altogether), so we have supplemented API checks with (1) selective scraping of retailer sites during the day, and (2) a real-time status check at time of carting for key retailers (Target, Walmart Grocery, and Kroger), so SmartSubstitution can be done within-carting if necessary.

Having said that, NO local carting can be 100% accurate, because there’s no way to know if someone in the store is walking around with the last 10 boxes of Kleenex in their cart. But for the 99%+ of cases, it works quite well.

SmartCommerce scans retailers at least daily for new products using your brand name, and automatically adds your products to your SmartSuite catalog. However, sometimes we can miss new products, particularly when:

– They use a new brand name that is different from your regular brand name

– If your brand name uses unusual characters and the retailer subs in other characters

– The product is in an entirely new category for your brand (you make detergent, but the new product is in pen form, or something).

If you find that a product is missing, please let your Client Success Lead know, and we will make sure it is added immediately!

Normally, stock status and price are updated at least every hour at every retailer for products in use in any link/implementation, and more often (up to every 10 minutes) for very active products. When we detect a change, all links are automatically updated with this information in less than 10 minutes. Most status changes for live links are correct within 15 minutes, but depending on when a retailer makes a change and we access their data, it can be up to an hour.

At times of unusually heavy traffic at retailers’ sites, retailers sometimes may temporarily block access to their product APIs, feeds, and/or pages, which impacts our ability to get updated information. In these cases, we will continue to ping the retailer to update the data, but the data will be temporarily “stale” – and this can last for several hours, and in rare occasions, even days.

SmartCommerce cannot predict or control these conditions, so in cases where it is imperative that data be correct (i.e., if there is a penalty in your area for displaying an incorrect price), that you include language in the Carting UI noting that “Price and availability may vary – please check the price in your cart to confirm.”

Local Stock Status

Given the volatility of local stock status, we have found that even the retailer can be providing inaccurate information in their APIs/Feeds (and actually, often are missing most local data altogether), so we have supplemented API checks with (1) selective scraping of retailer sites during the day, and (2) a real-time status check at time of carting for key retailers (Target, Walmart Grocery, and Kroger), so SmartSubstitution can be done within-carting if necessary.

Having said that, NO local carting can be 100% accurate, because there’s no way to know if someone in the store is walking around with the last 10 boxes of Kleenex in their cart. But for the 99%+ of cases, it works quite well.

This is SmartCommerce’s core competency. First, we integrate with retailers to accept their data via APIs, Product Feeds, and/or crawling – usually two of those are used per retailer, because retailer APIs are generally updated only once a day, but stock and prices changes can happen more frequently.

Creating and maintaining the connections between product and retailer requires sophisticated data analytics used by our Master Optimization Engine (affectionately known as MOE). It maps and remaps, using multi-variable layered ontological rules across multiple updates/hour for 10’s of millions of Product-Offer pairs, via:

– layered machine learning scripts

– advanced automated product recognition, using multi-variable algorithms

– logistic regression modeling

-Intelligent product price and availability interpolation

Our unique ability to obtain, unify, optimize, and keep the data constantly updated drives our carting applications, dynamic product substitution, personalized shopper UIs, etc.

Do we ever get it wrong? YES, absolutely – but we currently are automated at a >95% success rate and use automated scripts to identify where we may be wrong. For those, we have a team of extremely detail-oriented humans who consistently keep our overall unification integrity rate at better than 99% accuracy.

Miscellaneous (3)

If the product is available for sale, but Amazon or Walmart is blocking it getting to the cart, that’s normally because the product has been marked as “CRAP.” Don’t get angry, that’s not a reflection on your product quality, it’s an acronym for “can’t realize a profit,” and can happen for many reasons. This article does a pretty good job of explaining it, but the impact is that the retailer is deliberately blocking your ability to promote it by blocking access to carting it. If this is your brand, there is surely someone on your retailer team who is actively working to cure this situation – and if you are an agency, please check with your brand, as they probably have a timeline to work this out. In the meantime, we can “cart around” a CRAP-ed product by dynamically substituting another pack size or type, and then when the product is no longer blocked, it will automatically resume carting.

Amazon CRaP 101: What CPG Brands Need to Know – OneSpace

CPG products are one of the biggest categories at risk for ending up on Amazon’s “CRaP” list. Here’s everything your brand needs to know.

OneSpaceOneSpace: https://www.onespace.com/blog/2019/02/amazon-crap-101-what-cpg-brands-need-to-know/

Yes, SmartCommerce can provide a full catalog of your products to display in an iframe on your site, or on a hosted page. This “eShop” will display all of your products available at any retailer(among those you choose to include), and let a user collect and cart as many as they would like.

Our early consumer research taught us that people use their carts as de facto shopping lists where the online cart is basically where people put things they THINK they may want to buy, and then they sort it out.

They may seek product information from inside the cart, and may change package sizes or whatever from there … but at least you’ve gotten the product all the way to the cart, and the user has to actually remove it to not purchase it in their next online buy.

To mitigate confusion or issues, please DO always correctly set the consumer expectation that the product is about to be carted in your CTA … we don’t want it to be a surprise. To that end, “drop in your cart now” or “save this to your cart” are better CTAs than “learn more” or “buy now.”

Results and SmartSuite Reporting (14)

Check that you have set the filters for each data set that you are reporting on. The filters are specific to the view you are looking at.

Use the download function, under Transfers – Transfer Summary, which allows you to download an Excel document for deeper analysis.

Remember to select the campaign/brand in the second drop down box – that is the most likely reason you are not seeing it!

In a perfect world, the number of clicks that your ad network, email provider, or site software reports would align perfectly with the number of clicks reported in SmartSuite (which reflects the total clicks SmartCommerce received, minus any “suspicious” clicks). But in the real world, these numbers may vary – a little or a lot – for the reasons below.

Small discrepancies either way

Small discrepancies where SmartCommerce sees <10% differences in click numbers vs. your ad/platform reports should be expected and ignored. These can occur due to timing differences among servers, unexpected user behavior, or small incidences of the items covered below. But if you are seeing significant differences, please reference the below.

If SmartSuite is reporting significantly HIGHER clicks than what you are seeing in your campaign/site

If SmartSuite is seeing significantly more clicks than your campaign is seeing, it is normally because your platform or ad network is filtering some clicks that they either know (because the clicks are coming from them as, say, pre-renders) or divly suspect (because the click patterns are suspicious, like 10 fast clicks coming from a single source) are not from real users. While SmartCommerce has set up analytics and “honeypots” to identify pre-renders and bots, we may miss some of them.

Please advise us in this case and we will look into the discrepancy and report back to you. We know this is super-important to you and your client, and want to help get to the bottom of it asap.

If SmartSuite is reporting significantly LOWER clicks than what you are seeing in your ads

There are several potential causes of SmartCommerce reporting a LOWER number of clicks than your platform or network is reporting. They are listed below from most common to least common.

There is an intervening redirect that is getting hung up before we see the click. This is by far the most troublesome, because it means that interested shoppers are getting stopped on the way to the cart! This will normally present as an immediate and significant difference between the click numbers … and can only happen when there are redirects between the initial click and the SmartCommerce link. If we see those two things together, we almost always can find a redirect that is “hanging” on the way to the cart … and you’ll want to work with your ad provider ASAP to address it.

We are identifying something as a bot (and filtering it out of our reporting) that the ad network sees as legit traffic. To explain further

Any time something is on the internet, there will always be a mix of “real” and “bot” clicks (because bots are everywhere). To do our best to get to the “right” reporting of the real clicks, we have analytics in place to watch for suspicious click patterns. When we find them, we remove the clicks from your reporting, and we blacklist the IP addresses that drive them.

So, in any mix of clicks, there will be some number of:

• Really suspicious clicks” (for example, IP addresses that click your link 100 times in rapid succession). We pull these from your reporting

• Kind of suspicious clicks” (meaning, somewhat irregular but might actually be a person, like “clicked 4 times”). On these, we make our best guess based on the behavior, to determine whether this is a real or suspicious user … and we err on the side of being conservative.

• Really solid clicks (single clicks from real IP addresses that are not in on any bot lists). These are real clicks, and we count them!

Think of that middle third (“kind of questionable clicks”) as a dial: if the dial is set to “super conservative,” we’ll exclude ALL of the suspicious clicks. If it’s set somewhere in the middle, we’re excluding about half of them. If your ad network is doing the same but sets the dial just a little differently, they’ll get a different count.

The ad network tracking has an issue.

What to do: Please advise us if this is the case and we will look into it for you. The first thing we can do together is look at the actual link the network is using, to look for redirects. If there are not redirects in place, it would be very helpful if the ad network/platform could share the actual click report (with actual click times and any identifying info they have) so we can bump it up against our reporting to see if there is any pattern to the “missing clicks” that may help ID what is happening. For example, we would be able to see if some of the clicks we are filtering are seen as accurate by the network (we’re happy to add them back if we’re overzealous on filtering).

Please advise us in this case and we will look into the discrepancy and report back to you. We know this is super-important to you, and want to help get to the bottom of it asap.

It may seem like “a click should be a click” … but it’s not that simple. Any time something is on the internet, there will always be a mix of “real” and “bot” clicks (because bots are everywhere). To do our best to get to the “right” reporting of the real clicks, we adhere to IAB Rules for identifying and removing suspicious click patterns … and it’s important to know that identifying them is not black and white – it’s a bit fuzzy. While IAB has guidelines, some of them are subject to interpretation, and that interpretation is what leads to differences in counting.

In any mix of clicks, there will be some number of:

1. Really suspicious clicks” (for example, IP addresses that click your link 100 times in rapid succession). We pull these from your reporting.

2. Kind of suspicious clicks” (meaning, somewhat irregular but might actually be a person, like “clicked 4 times”). On these, we make our best guess based on the behavior, to determine whether this is a real or suspicious user … and we err on the side of being conservative.

3. Really solid clicks (single clicks from real IP addresses that are not in on any bot lists). These are real clicks, and we count them!

It helps to think of the handling of that middle third (“kind of questionable clicks”) as a dial: if the dial is set to “super conservative,” we’ll exclude ALL of the suspicious clicks. If it’s set somewhere in the middle, we’re excluding about half of them.

So, if your ad network is doing the same but sets the dial just a little differently, they’ll get a different count – accounting for the up to 20% variance both ways, that should be considered normal.

This is a bit of a trick question … because the real “benchmarks” that impact the carting rate on campaigns are actually not directly related to any SmartCommerce action … but they are worth laying out.

In the end, your carting rate is primarily determined by the number of shopper clicks on your ad/link. And the $ value of the carting is determined by the number of clicks times the number of products and the $ value of the products.

The carting action itself (which occurs post-click) doesn’t really impact either of those, although some brands have reported significantly higher CTRs on great “bundle” campaigns that save shoppers’ time. And there definitely is the potential for a negative impact on carting if the ad CTA does not set the expectation that the product is about to be placed in a cart (because a user surprised by a tab opening tends to quickly shut down the tab before the carting completes … which we track as a “Process Closed” and deduct from your transfers).

But beyond that, there’s no way to “benchmark” transfers to carts, beyond tracking the CTR … which, again, is driven by the reach, and all of the factors (like great creative!) that drive a strong click response.

Access to the SmartSuite reporting portal is provided to all Client and Reseller Partners.

Campaign data can be accessed at any time. All the data provided relates to the transfer of product from media/implementation to a retailer’s cart, including:

• Products transferred to carts

• Retailers receiving transfers

• Value of transfers (and “views” for “where to buy” retailers)

• Product substitutions made

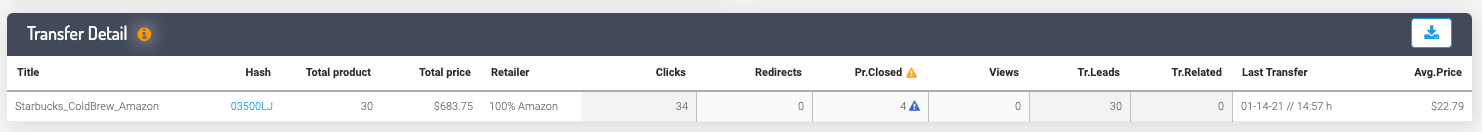

For Click2Cart you will see the following terms in your reporting dashboard:

Title: Name of link

Hash: The part of the URL that comes after click2cart.com/ – this is unique for every link

Total Product: Number of products that have been transferred by this link

Total Transfers Value: Total $ amount of products transferred by this link

Retailer: What retailer was used in this link

Clicks: Total number of Counted Clicks on the link (this is total clicks minus all scrubbed bots, internal clicks, pre-renders, etc.)

Redirect: Number of times the Shopper was redirected to either an Out of Stock page (if the retailer did not have the product or a substitute in stock), or an Out of Area page (if they were not in the service area of the retailer)

Process Closed: Number of times the Shopper clicked on the ad, but then closed the process before completing the transfer – or abandoned carting during a retailer login

Views: How many shoppers Viewed the product on a retailer PDP (for “where to buy” retailers)

Transfers: How many shoppers completed transfers (all retailers other than “where to buy” retailers)

Last Transfer: Day and time of last transfer (updated hourly)

Average Price: Average dollar value of the transfer (total $ divided by number of transfers)

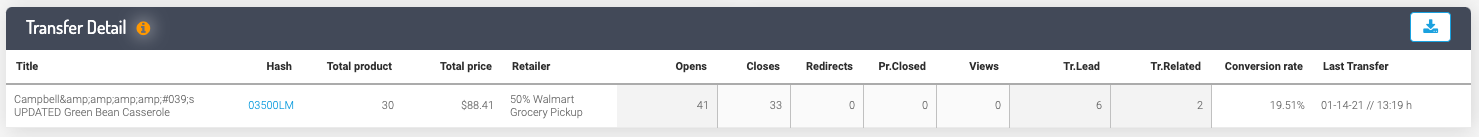

For Shopper’s Choice you will see the following terms in your reporting dashboard:

Title: Name of link

Hash: The part of the URL that comes after click2cart.com/ – this is unique for every link

Total product: Number of products that have been transferred by this link

Total price: Total $ amount of products transferred by this link

Retailer: Primary retailer selected by users using this link

Opens: Number of time the Shopper’s Choice fully rendered – this will be lower than your measured clicks, because always some consumers back out before rendering.

Redirects: Number of times the Shopper was redirected to either an Out of Stock page (if no retailer had any product or substitute product in stock), or an Out of Area page (if the consumer were not in the service area of any retailer with the product or sub in stock)

PR Closed: Number of times the Shopper chose a retailer, but then closed the process before completing the transfer

Views: Number of times the Shopper chose to go to a PDP of a retailer that did not have carting

Tr Lead: How many completed transfers there were that were all Lead products

Tr Related: How many completed transfers there were that included one or more Substitute products

Conversion Rate: Total transfers as a percentage of Opens (What percent of shoppers who opened the Shopper’s Choice transferred a product to a retailer)

Last Transfer: Day and time of last transfer (updated hourly)

Consumers typically save products to cart and do not check out immediately. Sometimes they cart build for a couple of weeks before they check out. Then, the data needs to be consolidated by Amazon and delivered to us.

While we can’t see all conversions, based on testing, we’ve seen Reported Cart-to-Sale Conversions as low as .1% and as high as 38% … and below are some of the key factors impacting both Actual Conversions, and Reported Conversions.

Things that ACTUALLY lower the online conversion – from biggest to smallest impact:

1. Not setting a clear expectation that the product will be carted on click. If an ad/post says “learn more”/”shop now”/nothing-at-all but you drop the product in the cart on the click, (a) you’re tricking the user and you’ll anger them, and (b) may attract a lot of clicks from users who are not interested in buying the product mentioned.

2. Bundling too many products into the cart, particularly those that are not normally purchased together. An example would be carting three sizes of diapers, assuming that the consumer will remove the wrong-sized diapers from the cart … you would reduce your conversion by at least 2/3.

3. Carting one version of a many-variant product, where another variant is ultimately selected/bought (only the initial variant will be tracked – so this is not a bad thing for overall sales, but lowers conversion of the reported item).

4. Aggressive retargeting that may successfully drive a consumer to buy offline before they place their online order (this is not a bad thing for overall sales, but just may lower online conversion).

5. Heavily carting substitute variants for OOS/3P items, particularly where the variant is substantially different. These will still be tracked at the retailer, as the product is carted via the link, but conversions may be lower if the item is too different from the one advertised.

Things that create LOWER REPORTED (THAN ACTUAL) online conversion

1. Competing affiliate* links at retailers that attribute the whole purchase to the last link clicked (virtually all retailers). The product will still convert, but you will not be able to see it in reporting. This is rampant around the holidays, when aggressive affiliate marketers are willing to invest to be the last click in heavily-laden holiday carts.

2. Services like “Honey,” or other coupon services that remove all competing attribution links in favor of their app links.

3. Driving “giftable” items to carts during the holidays, at times where consumers are likely to move the items to “wish lists” at the retailers (items moved to wish lists and later purchased for a consumer are not tracked to the initial link).

4. Measuring too soon – remember that many consumers hold higher-consideration products in their online carts for weeks or even months, before buying.

SmartSuite is typically updated on an hourly basis and the time zone for our portal is U.S. Central Time.

When the retailer is Login to Cart (Walmart Grocery) the login is handled on the retailer side. In this case, the transfer is recorded when it originated, which is pre-login (as the consumer is passed to the retailer after that point). Since Walmart Grocery does not share with us whether the consumer is or is not in a logged in state, we cannot tell which users went directly to the cart and who were stopped by the login request.

Think of it this way: the consumer is, say, in Facebook and sees a post. They click on the post and we have to essentially pass the order to Walmart Grocery for them to put in the cart. Walmart Grocery then handles knowing whether the consumer is in a logged in state or not, and knows whether to prompt the login or not. If your ad clearly specifies in the CTA that the carting will happen at Walmart Grocery, the consumer who chooses to click will either (1) be an Walmart Grocery customer already (so they are very likely to be logged in), or (2) to be Walmart Grocery-curious, and therefore likely to log in to check it out.

If you have more than 1 link that you ultimately need to see results for without including results of your previous campaigns from the same manufacturer catalog you can apply a “Label” to your links.

For Agencies: Our ops team has started to incorporate your campaign number (i.e: #123) as a tag to each new SmartLink.

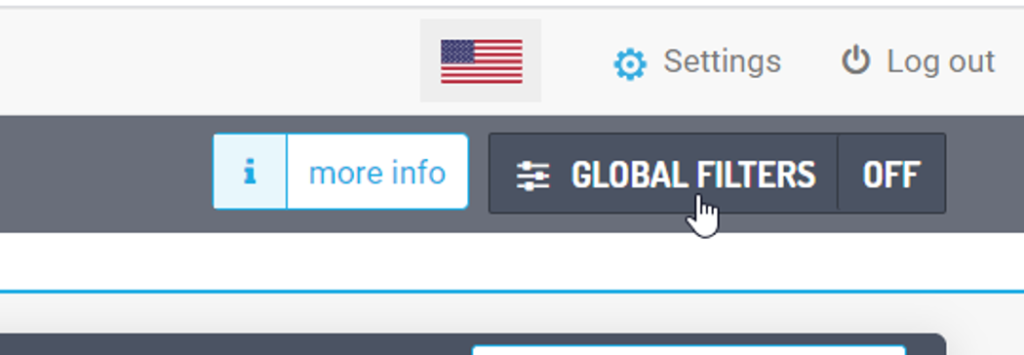

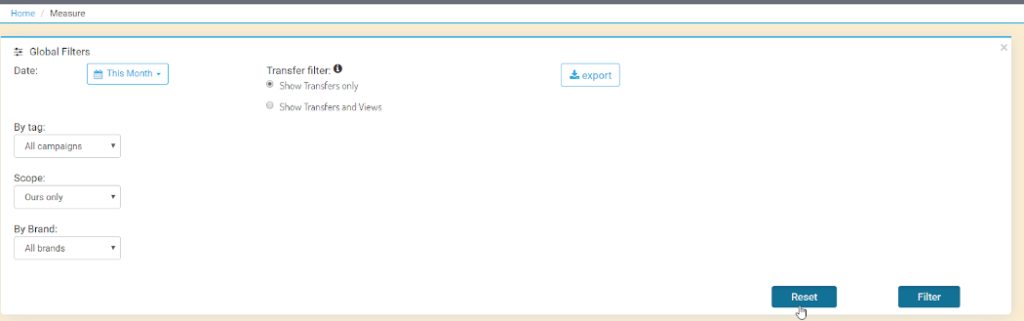

To filter by tag, go to “Measure>Click2Cart” section and select the “Global Filters” option at the top of the screen in SmartSuite.

Click “By Tags” and then select the tag we associated those links with. Once you have filtered the information you want to include, click on the “export” button to generate a downloadable report. After you have downloaded your report, make sure to click the “Reset” button to turn off Global Filters so you can see all of your campaign data. When the Global Filters feature is turned on the background color will appear light orange in color.

Pro Tip:Be sure to disable your Global Filters by clicking the “Reset” button once you have viewed the desired data. SmartSuite will keep them enabled until you disable them.

The agency can use its own click trackers if they like, as long as the Click2Cart link is used in its original form as the primary destination URL. Having said that, SmartCommerce is already tracking the clicks – including any that redirect for OOS, ones that are closed before rendering, and all that transfer. We’re happy to provide additional SmartSuite logins for other agency partners so they can see/track the results; please be sure to have those names and email addresses included on your campaign request forms.

Scrubbing is the process by which we flag activity as originating from an external bot, a SmartCommerce user on our internal network, a duplicate (opened 5 times from the same end user within 30 seconds or so), etc. There are many rules but that essentially covers it. We can also add new rules if needed. We could, for example, scrub clicks from a certain URL (i.e. stage.pantene.com) if they are using that address as a development environment to test the implementation of our widgets. If we added that rule then our scrubbing system could identify clicks, transfers, out of stocks (OOS), out of area (OOA), etc. from that URL (stage.pantene.com) and scrub them. This would result in activity from their development environment to be included in “Raw Clicks” and excluded in “Clicks”. If it’s a scrubbed OOA, then it could be one of us, on our VPN, opened one of the client’s links and received an OOA because we had an OOA postal code. Once the “scrubber” runs it will identify that the click came from inside our network and change it’s status from OOA to Scrubbed OOA.

“Raw clicks” is everything including scrubbed, “Clicks” is everything minus scrubbed.

SmartSite (1)

The first load of the carousel for a user in a location will take anywhere from 2 to 5 seconds depending on how the carousel is configured and how far down the chain SmartCart is loaded. After the initial load it will be a sub second until cache expires which happens every hour.

SmartSubstitution (4)

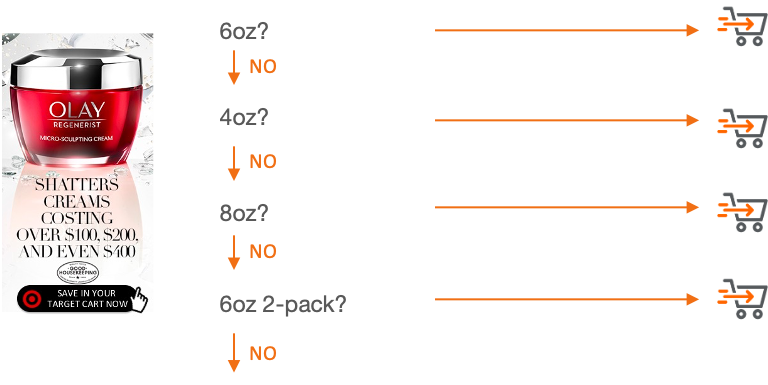

To keep your links carting, and avoid OOS dead-ends, we have two levels of SmartSubstitution: direct and indirect substitution. You can control these by determining a pick list, or you can let us manage this by default (recommended). Direct Substitution will only cart the EXACT same product, but in a different package size – and will choose from the closest to the farthest by size.

For example, if your lead product is a 12 oz shampoo but it’s OOS, we’d cart the 10 oz, then the 20 oz, then the 42 oz – and only if all were OOS would we then let the shopper know it was OOS.

If Indirect Substitution were enabled, after we’d exhausted the Direct Substitutes, we would roll to all similar products (the same-brand but different-fragrance shampoo, for example) before declaring the product OOS.

Under no circumstances would a product that was not from your brand ever be carted.

There is no additional charge, it’s a standard feature of the service. Our algorithm automatically determines the closest package size to substitute (and rolls to the next closest package size until it finds one in stock), so there is no need to provide us with the substitutes – though you can specify the order if you like.

SmartSubstitution can work in three ways:

1. Direct Substitution: (default) will cart the exact same product as an OOS product, but in a different package size – and will choose from the closest to the farthest by size. For example, if your lead product is a 12 oz shampoo but it’s OOS, we’d cart z, then the 10 oz the 20 oz, then the 42 oz – and only if all were OOS would we then let the shopper know it was OOS.

2. Direct + Indirect Substitution: If enabled, after we’ve exhausted the Direct Substitutes, we would roll to all similar products (for example, the same-brand but different-fragrance shampoo) before declaring the product OOS.

3. Custom Substitution: You can set the substitution order however you like!

1. If a product goes OOS or to 3P at the retailer, we can automatically adjust to cart the closest available

same-product at that retailer. In the case of CPG, we look for different pack sizes/variants, but in the case of something like a bike, we would look for other versions (colors?) of the exact same bike. This is called Direct Substitution and is turned on by default on every one of your links from us, unless you ask us to turn it off. (Quick note: At Amazon specifically, sometimes there is still a 1P offer “behind” a 3P in the buy box. In this case, we roll to the 1P offer before looking for any variants.)

2. If ALL Direct Substitutes are OOS or 3P, we can roll to Indirect Substitutes (not the exact product, but something very similar) to find an in-stock or 1P product to cart. You can have as many Indirect Substitutes as you like. If it looks like your product availability is highly variable, we will contact you to ask about Indirect Substitutes – or you can specify them at the time of the link request on any link. Normally, the above options seamlessly cover any OOSs and 3Ps, but in very rare cases (toilet paper last March), there is literally nothing to roll to. In these cases, we will redirect the consumer to our OOS message page, or any other page you’d prefer us to use. The only thing we highly recommend against is sending consumers to your PDP with the product OOS. Those are highly useful pages for competition to get shoppers to trade to a new brand. Second, we wanted to address your question about Notifications if a product goes to 3P or OOS.

1. We actually have an email alert for stock status changes in beta, and would be happy to have you be a tester :-). But you may want to say no, because #2.

2. Stock and buy-box status is a bit more … fluid … than it sounds, so want to be sure you know what you’d be getting into! With national retailers, there are cases where products move in and out of stock – or in and out of lead position in the buy box – several times a day. We had one product that we were tracking that was going OOS for 10 minutes of each hour at Walmart, presumably while they checked stock or something. That’s an unusual one, but not unheard-of. Additionally, products go in and out of stock in different geographies. Even Walmart and Amazon use delivery regions, and products can be in stock in one geography, and variable in another. And in cases like Walmart Grocery, there are 4200 different stores where stock status may change within-day. For these reasons, we highly recommend that instead of trying to manage turning the ad on or off, you let us use our SmartSubstitution – Direct and Indirect – to give the shopper and the brand the best outcomes – that’s what all of this was built to do.